How to Make the Most out of Your End of Financial Year

Your company’s financial year end determines when your corporate filings and taxes are due each year. Hence it is important to select your financial year wisely to maximise any tax incentives. In this article, we explore the considerations for selecting a financial year end date and the implications for those dates.

Choosing your Financial Year End Date

Singapore allows businesses to select their own Financial Year End date and it must be done on the date of incorporation. This can be a tricky decision to make. According to Accounting and Corporate Regulations Authority (ACRA), the common year end dates selected are 31 March, 30 June, 30 September, and 31 December.

Your very first Financial Year normally begins on the day of incorporation and ends on your selected Financial Year End date, as long as it is within 18 months from incorporation date.

Things to consider when selecting Financial Year End

Singapore’s corporate (both local and foreign) income tax is a flat rate of 17% on chargeable income. There are multiple tax exemption schemes that may benefit your business financially, some of which we touch on below.

Tax exemption for new companies

There is a tax exemption scheme to support new start-up companies for their first 3 consecutive Year of Assessment (YA). Maximum tax exemption is $200,000 in each YA.

Visit the ACRA website for more details.

Partial tax exemption scheme for companies

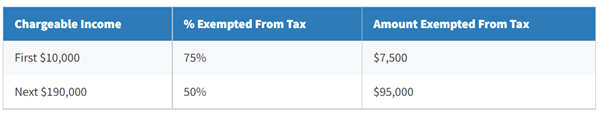

All companies are eligible for partial tax exemption (PTE), unless they are claiming the tax exemption for new start-up companies (above). Maximum tax exemption for YA 2020 onwards is $102,500.

Example in table below if your chargeable income is $200,000 for YA 2020 onwards.

Visit ACRA website for further information.

Business cycle

The ideal financial year-end really has more to do with your business cycles, which varies from business to business.

Wholesale and retailers who manage a high level of inventory may consider choosing a year-end that corresponds with the end of their peak period and presumably, a time when inventory is at its lowest.

This means less inventory has to be counted during stock-take, which decreases costs and increases accuracy. Furthermore, a quiet time of the year makes it easier to close the books as there are fewer transactions in-progress and more time available from support staff.

Synchronise with your holding company

If your business is a subsidiary of a holding company, it would be best to synchronise Financial Year End dates and is the most cost effective and simplest way.

Changing your company’s Financial Year End

ACRA allows you to change your company’s Financial Year End date for the current or previous financial year. It must be filed with the Accounting and Corporate Regulatory Authority (ACRA) via BizFile+ portal.

Related Articles

Boosting Your Business: Top Strategies for Improving Cash Flow

The Ultimate Guide to Receivables Financing: Boosting Your Business Cash Flow