Should I sell my unpaid invoice?

Sell Unpaid Invoice: What is an invoice?

Let’s start with the basics; an Invoice is a document sent to a customer (aka Debtor) specifying payment details for products or services provided by you / your company.

An invoice with credit terms gives rise to accounts receivable due 30, 60, 90 or even 120 days. This potentially leads to cash flow issues for the supplier. Many savvy businesses today opt to utilize their accounts receivable and sell unpaid invoice to finance their companies by:

- Selling their accounts receivable to a third party (known as factoring or invoice discounting). This is a true sale where the third party factor now owns the debt. Depending on the arrangement, the third party factor also notifies the debtor of the sale, and takes on responsibility to collect from the debtor.

- Borrowing cash using accounts receivable as collateral, a type of asset-financing arrangement. In this scenario the debtor is normally not notified that the accounts receivable has been utilized for financing.

- The above two options are provided by banks or traditional factoring companies. Obtaining finance from banks in today’s environment is a challenge. Therefore many companies today are turning to selling their outstanding invoices via alternative finance providers like PlatformBlack, MarketInvoice or InvoiceInterchange for more flexible and faster financing, instead of factoring companies

All the above allows businesses to obtain immediate cash flow necessary to meet their current and immediate cash demand.

So is it okay to sell unpaid invoice?

There are many advantages when you sell unpaid invoice, some of the benefits are:

- Funds released improves cash flow and provides the additional working capital to grow your business

- Immediate cash injection into the business – funds are normally disbursed between 2 – 7 working days

- High approval rates. The risk is assessed against the credit worthiness of your Debtor as opposed to your business itself

- Less hassle, more flexible and less restrictive than getting a bank loan

- Confidentiality. The debtor is unaware of the invoice sale thereby maintaining a close relationship with your customer (confidential facility)

- Allows you to concentrate on growing your business when your credit control function is outsourced to the finance provider (notified facility)

On the other hand, there are stigmas associated with companies that sell unpaid invoice or undergo debtor financing. Some see this as a potential sign of poor receivables management or credit control whilst some may associate this to a company who may be financially strained.

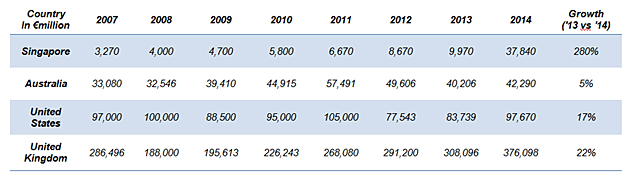

These stigmas are beginning to fade. Invoice financing is one of the most commonly utilised finance solutions for SMEs. Businesses across the world factor €2.37 trillion in a single year. In the UK, over €376 billion of client sales were factored in 2014. In Singapore, there has been a steady increase in factoring over the last 7 years with €37.8 billion factored in 2014 alone.

For business to sell unpaid invoice for cash is a universally accepted tool that is essential to effective cash flow management for SMEs and is a key to business continuity and business growth.

Nalinee Chinowuthichai is the co-founder of InvoiceInterchange, Singapore’s invoice trading platform, where SMEs can flexibly manage their cash flow by selling invoices to a network of investors who compete to provide cash advances.

Reference

[1] Factors Chain International, Statistic, searched on 7 May 2015

Related Articles

Boosting Your Business: Top Strategies for Improving Cash Flow

The Ultimate Guide to Receivables Financing: Boosting Your Business Cash Flow