Unveiling the Atradius Payment Barometer 2023: Downbeat Exports Outlook Poses Challenge for B2B Trading on Credit

The latest Singapore Atradius Payment Barometer for 2023 has shed some light on how businesses are coping with the challenging economic and trading environment in the context of their business-to-business (B2B) transactions. The report examines the payment behavior of B2B customers, focusing on how invoices are being paid and the measures implemented to prevent late payments and defaults. Let’s delve into the key takeaways from this crucial report.

Sharp Downward Trend on B2B Credit Sales

The study has found a significant decrease in credit sales among B2B businesses, dropping from 52% last year to just 32% this year. The decline was led by the electronics/ICT sector, highlighting concerns about export demand.

Longer Payment Term

In response to market competitiveness, businesses are offering their customers longer payment terms to attract more clients. On average, these terms are extended to 36 days from the invoicing date, which is 3 days longer than last year.

Reduction in Late Payments

The study has found a considerable decrease in late payments and bad debt, attributable to the significant decline in B2B sales on credit. Late payments now affect just 28% of outstanding invoices, while bad debts stand at 3%, a significant improvement from the previous year’s 9%

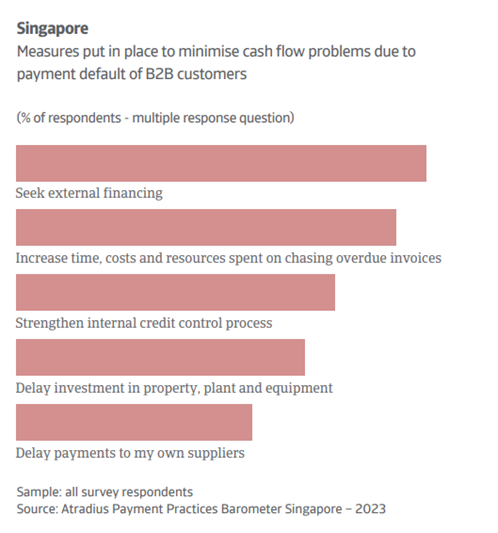

Cash Flow Measures

To combat the cash flow challenges, especially bad debt, businesses are opting for:

- External financing Businesses are turning to Bank loans and trade credits to help finance their businesses in the past 12 months.

- Increase resources in managing invoices, especially overdue ones.

- Strengthen the internal credit control process.

- Delay investment in property, plant, and equipment.

- Delay payments to payments to their suppliers.

Looking Ahead

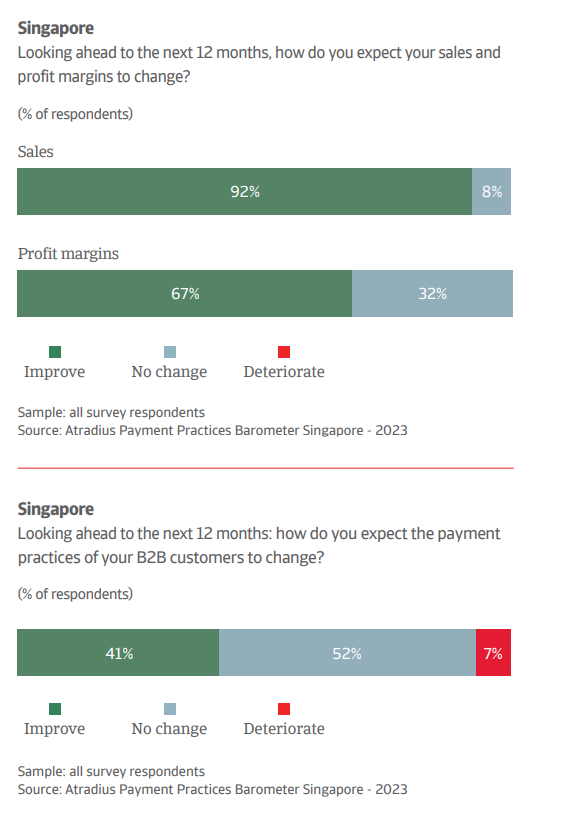

Despite ongoing challenging factors affecting the local economy, businesses in Singapore generally maintain a positive outlook for the upcoming year. 92% of businesses reported expecting an increase in demand for their products and services, with 67% anticipating growth in profitability.

From the perspective of payment behaviour, 52% of surveyed businesses believe that there will be an improvement in the Days Sales Outstanding (DSO), ore, reflecting a forward-thinking approach to strategic credit management.

The main concerns expressed by surveyed businesses for the next 12 months are

- Interest rate volatility which may result in a decline in demand.

- Prolonged global economy downturn.

- Cash flow issues and potential liquidity shortfall.

Related Articles

Boosting Your Business: Top Strategies for Improving Cash Flow

The Ultimate Guide to Receivables Financing: Boosting Your Business Cash Flow