How Technology has Boosted Businesses During the Pandemic

Singapore SMEs are battling head on the challenges brought about by the pandemic. With the help of technology, more SMEs are pivoting from traditional business models to being more online and digital. Many are also adapting and strengthening their existing online offerings as more customers are moving from offline to online purchases.

Grow your customers via digitalisation

Having an online offering is not only to capture more sales but it can also act as a major conduit of your marketing strategy. According to a recent PayPal study, 53 per cent of respondents are using social media as a selling channel and capturing new customers, while 42 per cent felt that social media is the best way to grow a business.

The survey also reported both positive and negative changes that were brought by the pandemic.

Positive impacts:

- 17 per cent saw an increase in online customers.

- 12 per cent experienced an increase in demand.

- 11 percent saw an increase in variety of product/service offerings.

Negative impacts:

- 31 per cent experienced a decrease in demand.

- 29 percent saw a loss in offline customers.

- 27 percent reported experiencing supply chain issues.

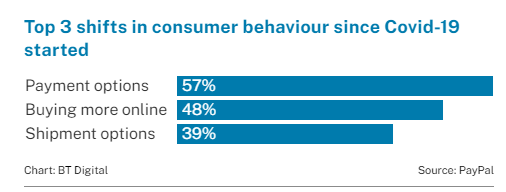

Top 3 changes in consumer behaviour since the onset of COVID-19 are:

- 57 per cent cited a greater reliance on digital payment methods.

- 48 per cent reported more online purchasing.

- 39 per cent reported a greater preference to have shipment options.

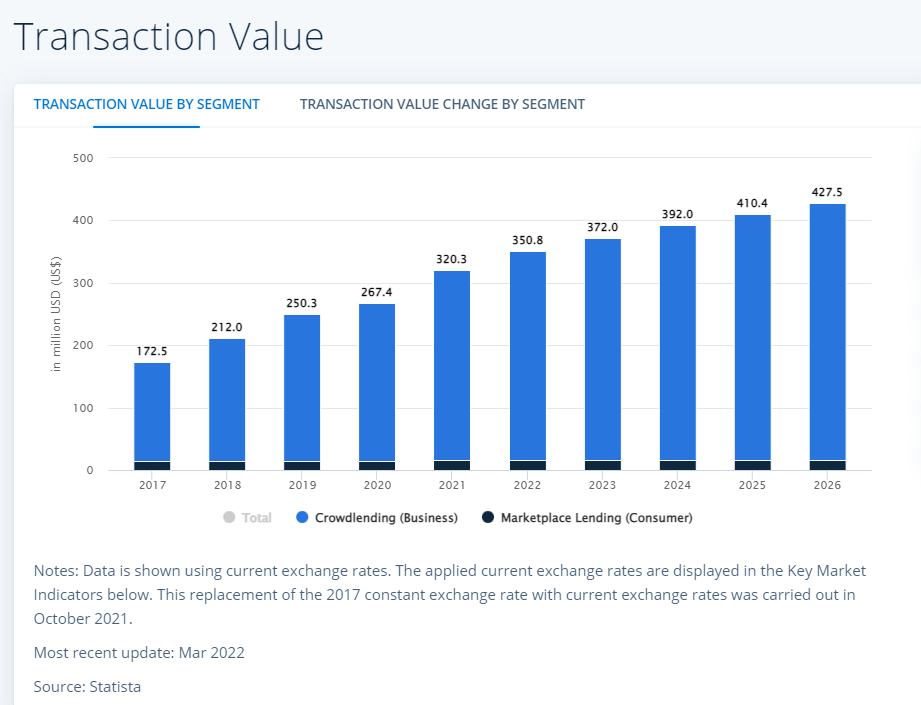

Funding via Fintech online platforms

Technology has also allowed SMEs to obtain funding easier than ever with the emergent of fintech firms. Total transaction value in the Alternative Lending segment is projected to reach US$350.8m in 2022.

At InvoiceInterchange, we have served a large number of businesses who were looking for a trusted finance partner to help grow their business via invoice financing.

We have a smart-platform that simplifies and quickens both the onboarding and funds drawdown processes. It is flexible and online. Simply upload your outstanding customer invoices and funds are in your bank account within 24 hours.

Forward looking

Singapore SMEs will continue to leverage more online solutions over the coming years. Businesses are more optimistic than a year ago and are pushing towards a more digitalised future.

Related Articles

Mastering Cash Flow Management: Strategies for Seasonal Fluctuations

The Working Capital Challenge: How Long Credit Terms Could Be Holding Your Business Back