SMEs Are Turning to Alternative Financing

GrabFinance together with Bloomberg Media Group recently conducted a survey ‘SMEs in a New Decade, New Economy’ to better understand the needs of Micro, Small and Medium Enterprises (MSMEs) in the ASEAN region. It also provides an oversight of how Alternative Financing can support MSMEs growth.

The research was based on correspondents from 600 MSMEs across four ASEAN countries: Singapore, Malaysia, Thailand, and the Philippines.

MSMEs now account for more than 90% of registered businesses in the ASEAN region, contributed between 30 to 53 percent of GDP of the surveyed ASEAN countries. Below is a summary of the survey’s findings.

Business Development Trend

MSME’s highest priorities over the next few years are (a) business growth and overseas expansion (38 percent), and (b) the development of new products and services (33 percent). Business owners intend to achieve these goals by leveraging technology.

MSMEs Financing Needs

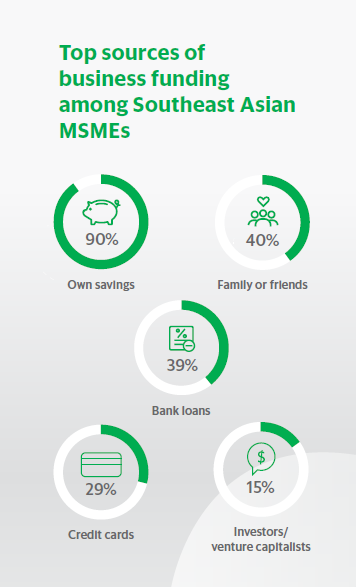

Financing is a main area of concern among MSMEs. Majority of business owners are currently funding their businesses using their own savings. Over two thirds of business owners express the need for additional external financing to achieve their expected growth and expansion.

To obtain the necessary funding, more than half of these entrepreneurs will likely turn to non-traditional sources of financing for example crowdfunding, peer-to-peer lending, angel investors, external investors or venture capitalists and government assistance programmes.

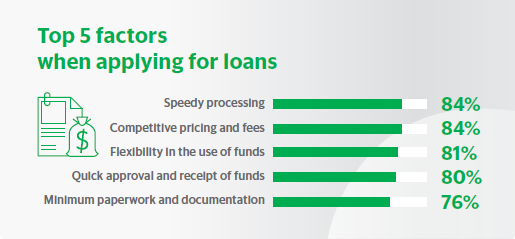

When accessing financing options, below are the top 5 factors that business owners look for:

- Speed of processing

- Competitiveness of fees

- Flexibility in the use of funds

- Speed of approval

- Reduced paperwork

Invoice Finance at InvoiceInterchange

InvoiceInterchange is a alternative financing company, simple online financing to MSMEs through an invoice finance platform. Businesses can easily apply via an online application form with approval decisions within 24 to 72 hours. We are also integrated with Xero accounting platform, where pre-approvals can be obtained in minutes.

It is simple and flexible with no contract lock-ins, no minimum spend, straightforward pricing and businesses choose to fund invoices as and when needed.

Using our smart platform, you can draw down funds against your outstanding invoices with a few clicks of a button. No more paperwork and funds can be in your bank account in as little as 24 hours after verification.

Related Articles

Alternative Finance, Working Capital Solution for SMEs

Invoice Factoring Basics: How to pick the right Finance company

Related Articles

Singapore Businesses Remain Positive Outlook for 2024

Unveiling the Atradius Payment Barometer 2023: Downbeat Exports Outlook Poses Challenge for B2B Trading on Credit